Thought Leadership / Commentary / Direct Investing for Family Offices Part 1: Where to Begin

Direct investing is difficult. It should not feel overwhelming.

GET A 5-STAGE ROAD MAP TO STRENGTHEN YOUR DIRECT INVESTING APPROACH.

Direct Investing Strategy

Direct investing is broadly defined as a debt or equity investment made directly into an operating company or real estate.

Many ultra-high net worth individuals and family offices continue to increase their direct investment allocations.

Direct Investing Remains a Priority for Family Offices

29% of family offices allocate between 10% and 20% of their portfolio to direct investments, while another 35% allocate more than 30%. Direct investments are split almost evenly between real estate (37%) and operating businesses (33%) with venture capital growing (20%).

Source: Citi Private Bank 2022 Family Office Survey Report.

Direct Investing Rewards

What makes direct investing so attractive to family offices?

• Growth from potentially outsized investment returns relative to public markets (financial capital).

• Ownership of a tangible business for shared family experiences and education (human capital).

• Alignment with a family’s longer-term investment horizon and values (social capital).

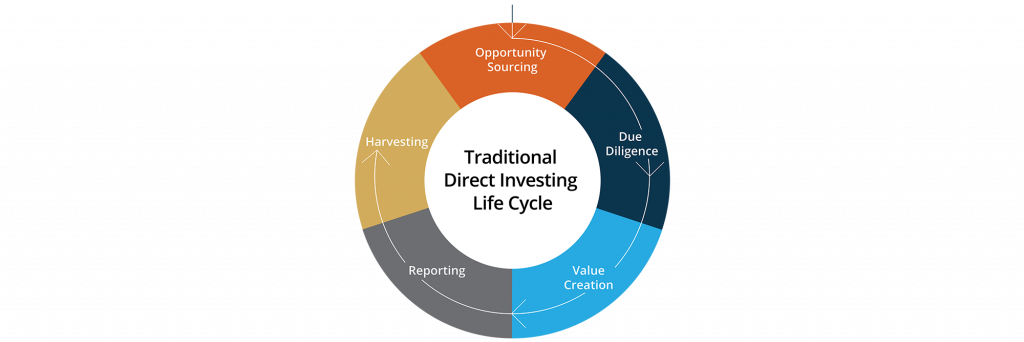

Traditional Approach – Build a Portfolio

Families often start making direct investments by reactively investing in deal(s) and chasing disparate information in an effort to update stakeholders and evaluate performance.

Perspective

Leading families who invest in the business of running a direct investment strategy are best positioned to achieve their goals.

Anecdotally, we’ve seen many families not fully implement a robust direct investing model and face situations that have not met financial or family expectations.

This often traps capital and even worse creates a negative family dynamic.

Families Are Unique. Their Approach Should Be Too

While family offices can and should emulate the rigor and process-oriented approach that leading professional private equity investors take, family offices serve a unique set of needs and characteristics that are often developed across generations, including:

• Goals related to family financial capital, social capital, and human capital.

• Strengths and networks rooted in entrepreneurial and philanthropic endeavors.

• Dynamics inherent in all families with a wide range of direct investment knowledge.

• Interests that are diverse within and outside the family unit.

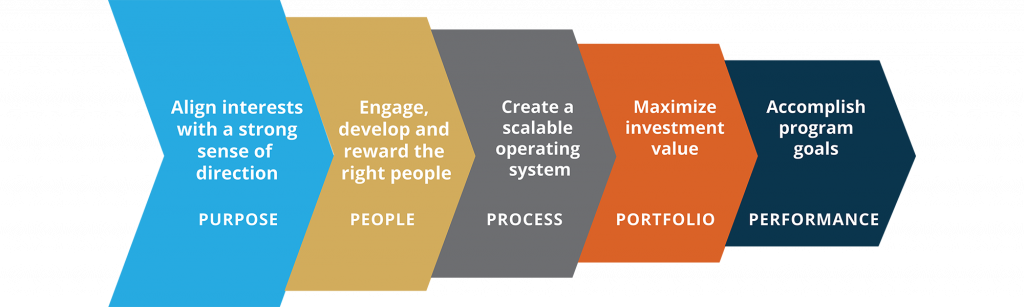

A New Approach – Optimize Your Direct Investing Program

To harness a family’s unique characteristics and optimize its direct investing approach we created the V3 5-Part Direct Investment Program Framework. An integrated approach that includes the important steps of the traditional private investing lifecycle through the lenses of a family office.

Perspective

Given the potential for continued and increasing economic headwinds that are impacting operating businesses globally, families with existing holdings and families looking to make new investments should consider a renewed look at their direct investing approach. More specifically, ensure you are focusing on building a successful direct investment program that is so much more than a portfolio of direct investments.

This is Part 1 of a 3-Part series. Watch this space for Part 2 – Direct Investing for Family Offices – Opportunities and Risks in Today’s Markets.

Our Road Map Service includes a simple set of interviews and direct investment portfolio analyses. At the completion of what is approximately a 45-day process you receive a customized Road Map Report which identifies opportunities for you to implement 20 key actions to strengthen your Direct Investment Program.

Schedule a call with an expert to start creating your Direct Investment Program Road Map.

Contact us at either investments@v3-limited.com or info@mirador.com.

Posted by Mirador

Posted by Mirador